Luxembourg is the premier private banking centre in

the Eurozone and the second largest fund centre in the

world.

Due to its political and economic stability as well

as its innovative and international orientation, the

Luxembourg financial centre is an ideal hub for private

and institutional investors from all over the world.

ATTRACTIVENESS

Luxembourg has an AAA credit rating.

Luxembourg has a flexible legal and regulatory environment designed to promote and attract foreign investment.

Luxembourg is not included in the OCDE uncooperative tax havens list.

LUXEMBOURG AS THE JURISDICTION OF CHOICE

• Luxembourg is home to an attractive tax regime; accordingly, Luxembourg entities may be structured in such a

way so as to assure tax neutrality.

• A wide choice of international compliant wealth planning vehicles, (both funds and corporate structures)

• Aggregate general corporate profit tax rate of 29.22 % (however under certain conditions tax relief may be

granted, e.g. participation exemption, IP box regime, others)

• Extensive double tax treaty network and access to EU Directives

• Broad participation exemption regime (dividends, liquidation proceeds and capital gains)

• No withholding tax on interest and royalties

• Limited capital gains taxation for non-residents

• Leading investment fund centre in Europe and second only in the world behind the United States

• Investment Funds are generally not liable to corporate income tax, municipal business tax and net wealth tax

• Rate of tax on the payments of royalties, interest and on partial or complete proceeds from liquidation: 0%

• Rate of value-added tax (VAT): (maximum) 17%

• Preferential taxation of Companies for Intellectual Property: 5.84%

• Over ˃ 70 double tax treaties signed following OECD model.

Luxembourg as a Tool Box

Luxembourg offers a number of wealth planning structures, both regulated (under the financial regulator supervision, CSSF) or

unregulated, depending on the needs of the client or the project.

SOPARFI (Holding company)

Insurance

Securitisation

SPF

• Assets eligible to participation exemption regime

• Carried interest

• Real estate (indirectly)

• IP Assets

• Specifically designed for “private” investors

• Passive asset management (accumulation of investment income in a tax neutral vehicle)

• Securitisation of all kind of assets or risks linked to any of these assets.

• May have access to EU directives and double tax treaties (case-by-case analysis)

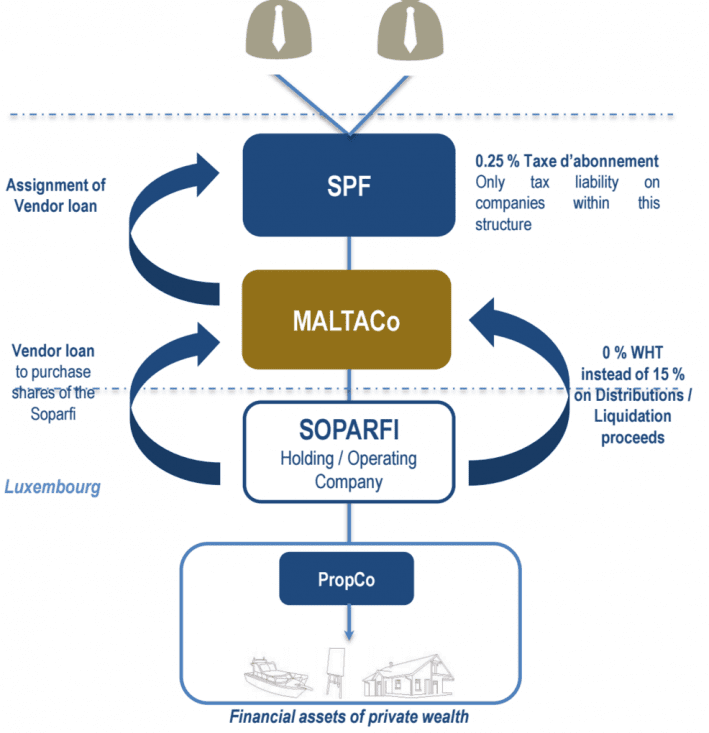

Private Wealth Management Company (“SPF”) and Malta Company

Case

• Client wishing to invest in both commercial and

private real estate.

Envisaged solution

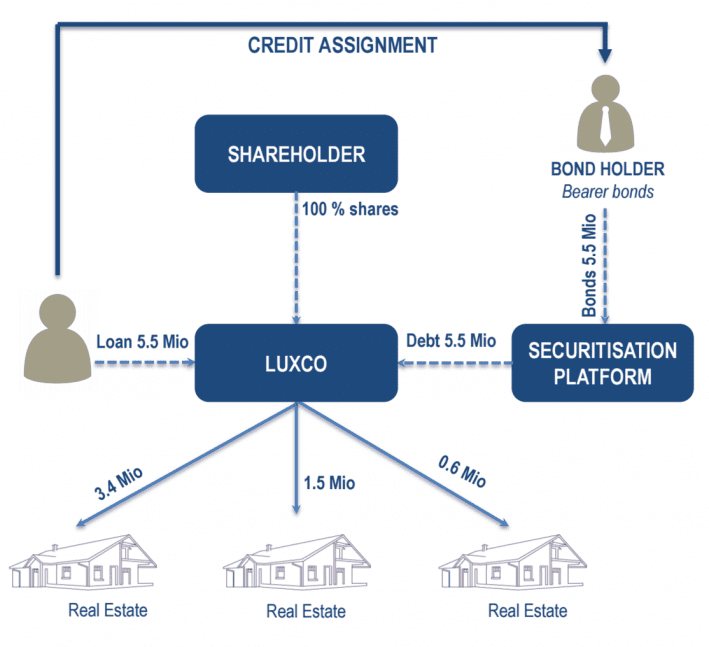

• Setting up a dedicated Soparfi which is part of an existing securitisation platform which will acquire the real estate on behalf of the client.

Benefits

• Structure can be opaque or transparent.

• Unregulated structure.

• Maximum protection given to the client due to

the bonds issuance.

Life insurance / Restructuring Foreign Holding Structures

Case

• The client is a wealthy business man

• He is concerned about his privacy and he would like to increase his asset protection

• Upon his demise he wishes that the asset is transferred to his wife and child in a

smooth way.

Envisaged solution

• The client concludes a life insurance policy, of which he is the policyholder and the

insured person.

• Investments portfolio held by the Holding company is transferred to the Insurance

Company as premium contribution.

• The Holding company can be liquidated further to the transfer of the insurance

company of the assets previously held

• Wife and children are appointed as beneficiaries of the life insurance policy.

Benefits

• Out of the scope of CFC rules

• No capital gain tax

• Tax deferral on income accrued within the policy

• Additional layer of privacy and asset protection (e.g. insurance secrecy and investor

protection)

• No long probate on insurance proceeds to be transferred to beneficiaries upon client’s

demise.

Trust & wealth structuring services

We provide a “one-stop-shop” service to meet the needs of our customers. A person / team dedicated to your project will be

made available to ensure the launch until its completion.

To this end, we will ensure the following services in addition to traditional banking services :

• Guidance and support on the choice and establishment and management of the legal structure

• Liaison with our preferred trust and fiduciary partners on all aspects of the structure

• Provision of Luxembourg resident director if required

• Provision of registered address and ancillary services

We can provide assistance and advice on a comprehensive range of wealth structuring solutions that will protect your assets

and offer your family security and an enduring legacy. We have an expertise and experience in structuring complex

international structures such as trusts, foundations and fund structures in different jurisdictions, and work closely with other

professionals to provide a tailored solution for managing and preserving wealth.

Please fill out the form and one of the recommended banks will contact you directly per email or phone.

[gravityform id=”1″ name=”Contact “]

Best Regards

Stefan Katafai

+34 637 97 37 42

I represent very wealthy Buyers and Sellers.

Banks ofLuxembourg – Key words

ABLV Bank Luxembourg S.A. ABN Amro Bank (Luxembourg) S.A. ABN AMRO Advanzia Bank S.A. Agricultural Bank of China (Luxembourg) S.A. (new) Agricultural Bank of China, Luxembourg Branch (new) Allfunds Bank International S.A. (new) Andbank Luxembourg Argentabank Luxembourg S.A. (closed) BEMO EUROPE – BANQUE PRIVEE (new) BGL BNP Paribas BNP Paribas A+ A1 A+ BHF-BANK Aktiengesellschaft, Niederlassung Luxemburg (closed) BHF-BANK International BHW Bausparkasse Aktiengesellschaft, Hameln (Allemagne), succursale de Luxembourg BNP Paribas Securities Services, Paris (France), succursale de Luxembourg BNP Paribas BNP Paribas, Paris (France), succursale de Luxembourg BNP Paribas BSI Europe S.A. Banca March, S.A., Luxembourg Branch Banca Popolare dell’Emilia Romagna (Europe) International S.A. Banco BTG Pactual Luxembourg S.A. (new) Banco BTG Pactual, Luxembourg Branch (new) Banco Bradesco Europa S.A. Baa2 Banco Espírito Santo, S.A., succursale de Luxembourg (closed) Espírito Santo Banco Itaú Europa Luxembourg S.A. (closed) Banco Popolare Luxembourg S.A. (P)Ba3 Banco Safra S.A., Luxembourg branch (new) Bank GPB International S.A. (new) Bank Leumi (Luxembourg) S.A. Bank of China (Luxembourg) S.A. Bank of China Limited, Pékin (République Populaire de Chine), Luxembourg Branch A1 Bank of Communications (Luxembourg) S.A. (new) Bankinter Luxembourg S.A. Bankinter Banque BCP S.A. BPCE Banque Carnegie Luxembourg S.A. Banque Degroof Luxembourg S.A. Banque Hapoalim (Luxembourg) S.A. Banque Hapoalim (Suisse) S.A., Zurich (Suisse), succursale de Luxembourg Banque Havilland S.A. Banque Internationale à Luxembourg BBB+ A3 A- Banque J. Safra Sarasin (Luxembourg) SA A Banque LBLux S.A. (closed) BayernLB Banque Puilaetco Dewaay Luxembourg S.A. Banque Raiffeisen Raiffeisen Banque Transatlantique Luxembourg S.A. Banque centrale du Luxembourg Banque de Commerce et de Placements S.A., Genève (Suisse), succursale de Luxembourg Banque de Luxembourg S.A. Banque de Patrimoines Privés Banque de l’Europe Méridionale, succursale de Luxembourg (closed) Banque et Caisse d’Epargne de l’Etat, Luxembourg Aa2 AA+ Banque Öhman S.A. Bausparkasse Schwäbisch Hall A.G., Schwäbisch Hall (Allemagne), succursale de Luxembourg Bayerische Landesbank, Niederlassung Luxemburg BayernLB Brown Brothers Harriman (Luxembourg) S.C.A. CACEIS Bank Luxembourg Crédit Agricole CATELLA BANK S.A. CREDIT SUISSE AG LUXEMBOURG BRANCH Credit Suisse Caixa Geral de Depósitos SA, Lisboa (Portugal), succursale de Luxembourg China Construction Bank (Europe) S.A. (new) China Construction Bank Corporation, Luxembourg Branch (new) China Merchants Bank Co., Limited Luxembourg Branch (new) Citco Bank Nederland N.V., Amsterdam (Pays-Bas), Luxembourg branch Citibank International Limited, Luxembourg Branch Clearstream Banking S.A. AA AA Commerzbank AG, Filiale Luxemburg Commerzbank Commerzbank International S.A. Commerzbank Baa2 Compagnie de Banque Privée Quilvest S.A., en abrégé CBP Quilvest S.A. Cornèr Banque (Luxembourg) S.A. Credem International (Lux) Crédit Agricole Corporate and Investment Bank Luxembourg Branch Crédit Agricole Crédit Agricole Luxembourg Crédit Agricole Crédit Suisse (Luxembourg) S.A. Credit Suisse DEPFA Pfandbrief Bank International S.A. A- DNB Luxembourg S.A. DNB DZ PRIVATBANK S.A. DZ Bank AA- AA- Danieli Banking Corporation S.A. (new) Danske Bank International S.A. Danske Bank DekaBank Deutsche Girozentrale Luxembourg S.A. DekaBank Deutsche Girozentrale, succursale de Luxembourg Delen Private Bank Luxembourg S.A. Deutsche Bank A.G., Frankfurt (Allemagne), succursale de Luxembourg Deutsche Bank Deutsche Bank Luxembourg S.A. Deutsche Bank BBB+ Deutsche Postbank AG Zweigniederlassung Luxemburg (new) Deutsche Bank Deutsche Postbank International S.A. (closed) Deutsche Bank Dexia LdG Banque S.A. (closed) Dexia EFG Bank (Luxembourg) S.A. East West United Bank S.A. Edmond de Rothschild (Europe) Erste Europäische Pfandbrief- und Kommunalkreditbank Aktiengesellschaft in Luxemburg (closed) Commerzbank Eurobank Private Bank Luxembourg S.A. Eurobank Ergasias Europäische Genossenschaftsbank S.A. – European Cooperative Bank S.A. – Banque Coopérative Européenne S.A. Fideuram Bank (Luxembourg) S.A. Fortuna Banque s.c. Frankfurter Volksbank International S.A. (closed) Freie Internationale Sparkasse S.A. Garanti Bank, Istanbul (Turquie), succursale de Luxembourg HSBC Bank Plc., Luxembourg branch (new) HSBC HSBC Private Bank (Luxembourg) S.A. HSBC HSBC Securities Services (Luxembourg) S.A. HSBC HSBC Trinkaus & Burkhardt (International) S.A. HSBC HSH Nordbank A.G., Kiel (Allemagne), succursale de Luxembourg HSH Nordbank HSH Nordbank Securities S.A. HSH Nordbank Hauck & Aufhäuser Privatbankiers KGaA, Niederlassung Luxemburg Hypothekenbank Frankfurt International S.A Commerzbank A- Baa3 IKB Deutsche Industriebank A.G., Filiale Luxemburg ING Luxembourg ING Group Industrial and Commercial Bank of China (Europe) S.A., en abrégé ICBC (Europe) S.A. (P)A1 Industrial and Commercial Bank of China Ltd., Pékin (République Populaire de Chine), Luxembourg Branch J.P. Morgan Bank Luxembourg S.A. Joh. Berenberg, Gossler & Co – Berenberg Bank -, Hamburg (Allemagne), succursale de Luxembourg John Deere Bank S.A. KBL European Private Bankers S.A. Keytrade Bank Luxembourg S.A. LBBW Luxemburg S.A. (closed) LBBW Aaa La Française Bank Landesbank Baden-Württemberg Luxemburg Branch LBBW Landesbank Berlin AG, Niederlassung Luxemburg (closed) Landesbank Berlin International S.A. (closed) Lombard Odier (Europe) S.A. M.M. Warburg & CO Luxembourg S.A. MEDIOBANCA INTERNATIONAL (LUXEMBOURG)S.A. Mediobanca Mirabaud & Cie (Europe) S.A. (new) Mitsubishi UFJ Global Custody S.A. Mizuho Trust & Banking (Luxembourg) SA NORD/LB COVERED FINANCE BANK S.A. (closed) NORD/LB A BBB NORD/LB Luxembourg S.A. Covered Bond Bank NORD/LB Aa1 BBB+ Natixis Bank BPCE Nomura Bank (Luxembourg) S.A. Nordea Bank S.A. Nordea Northern Trust Global Services Ltd, London (Royaume-Uni), Luxembourg Branch Novo Banco S.A., Succursale de Luxembourg (new) PayPal (Europe) S.à r.l. et Cie, S.C.A. Pictet & Cie (Europe) S.A. RBC Investor Services Bank S.A. AA- RBS Global Banking (Luxembourg) S.A. (closed) RBS RCB BANK LTD, Luxembourg branch (new) SMBC Nikko Bank (Luxembourg) S.A. Sal. Oppenheim jr. & Cie Luxembourg S.A. Deutsche Bank Skandinaviska Enskilda Banken S.A. SEB Societe Generale Bank & Trust S.A. Société Générale A Société Européenne de Banque S.A. Baa1 Société Générale Capital Market Finance S.A. (new) Société Générale Société Générale Financing and Distribution (new) Société Générale Société Générale LDG Société Générale Société Nationale de Crédit et d’Investissement Standard Chartered Bank Luxembourg Branch (new) Standard Chartered State Street Bank GmbH, Zweigniederlassung Luxemburg State Street Bank Luxembourg S.C.A. Sumitomo Mitsui Trust Bank (Luxembourg) S.A. Svenska Handelsbanken AB (Publ), Stockholm (Suède), succursale de Luxembourg Handelsbanken Svenska Handelsbanken S.A. (closed) Handelsbanken Swedbank AB (publ) Luxembourg Branch Swedbank TD Bank International S.A. The Bank of New York Mellon (International) Ltd., Luxembourg Branch The Bank of New York Mellon (Luxembourg) S.A. AA- AA- The Bank of New York Mellon SA / NV, Luxembourg Branch The Royal Bank of Scotland Plc, Luxembourg Branch (new) RBS UBI Banca International S.A. UBI Banca UBS (Luxembourg) S.A. UBS UniCredit International Bank (Luxembourg) SA UniCredit Baa1 UniCredit Luxembourg S.A. UniCredit A3 BBB Union Bancaire Privée (Europe) S.A. VP Bank (Luxembourg) SA Wüstenrot Bausparkasse AG, Ludwigsburg (Allemagne), succursale de Luxembourgluxembourg private banking industry,return on assets private banking,banque de luxembourg,role of private banker presentation,luxembourg online banks

banque de luxembourg address,cbp quilvest,ohman bank,luxembourg online banks